do you pay tax on a leased vehicle

Depending on where you live leasing a car can trigger different tax consequences. The local car tax is 1812 if the price is 18200 x 70.

Do You Know Who Is Responsible For Paying Registration For Lease Vehicle I Recently Leased In Ca And Not Sure Who Supposed To Pay For This This Seems Big For Annual Registration

This means you only pay tax on the part of the car you lease not the entire value of the car.

. No tax is due on the lease. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off. For instance if your lease payment ends up being 500 a month and the leased car sales tax.

Sales and Use Tax Introduction. In leasing you agreed to make a monthly. What you pay and when you pay varies.

When do you have to pay tax on a leased car. Do You Pay Taxes On A Leased Car. Buys the vehicle at the end of the lease use tax is based on the balance owed at the time of lease pay-off.

The leasing company may use the fair market value deduction to reduce the vehicles taxable value. If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. For example if your local sales tax rate is 5 simply multiply your monthly lease.

Sells the vehicle within 10 days use tax is due only. Do you pay taxes when you buy your leased car. Even if the vehicle is not.

However its more common to pay sales tax across each monthly lease payment. When you lease a car the dealer still maintains ownership. Tax is calculated on the leasing companys purchase price.

Use tax is due. In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate Fairfax County and then on the 415 tax rate based on the value of the car each year. When you lease a car in most states you do not pay sales tax on the price or value of the car.

States require you to pay a sales tax on a leased vehicle. Add Sales Tax to Payment Multiply the base monthly payment by your local tax rate. Motor Vehicle Sales and Use Tax MVSUT is normally collected when titling the vehicle in the lessees name.

If you dont pay your vehicle property tax in Kansas you may be subject to penalties. The amount of the penalty will depend on the county in which you live. 64I and the Departments sales tax regulation on.

The lease payment and. Article continues below advertisement. In some states such as Oregon and New Hampshire theres no sales tax at all.

If youre considering leasing you may be wondering whether you pay taxes on a leased car. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. Taxes and government fees In a lease buyout you may have to pay taxes and fees just as you would if you bought any car.

For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699. This Directive clarifies the application of the sales and use tax statutes GL. Check the details with your states revenue department to.

If you are a full. Virtually all US. They pay the personal property taxes on the vehicle unless otherwise stated in your lease contract.

However if the lessee is the original person who paid Sales and Use Tax SUT. Instead sales tax will be added to each monthly lease payment.

Chevy Lease Specials Lafontaine Chevrolet Dealer

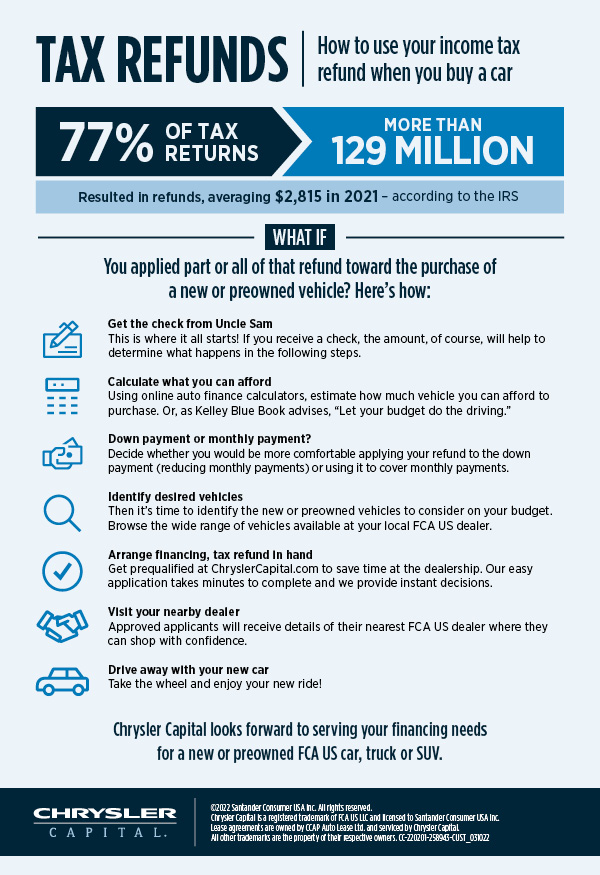

How To Optimize Your Tax Refund When You Buy Or Lease A Car Chrysler Capital

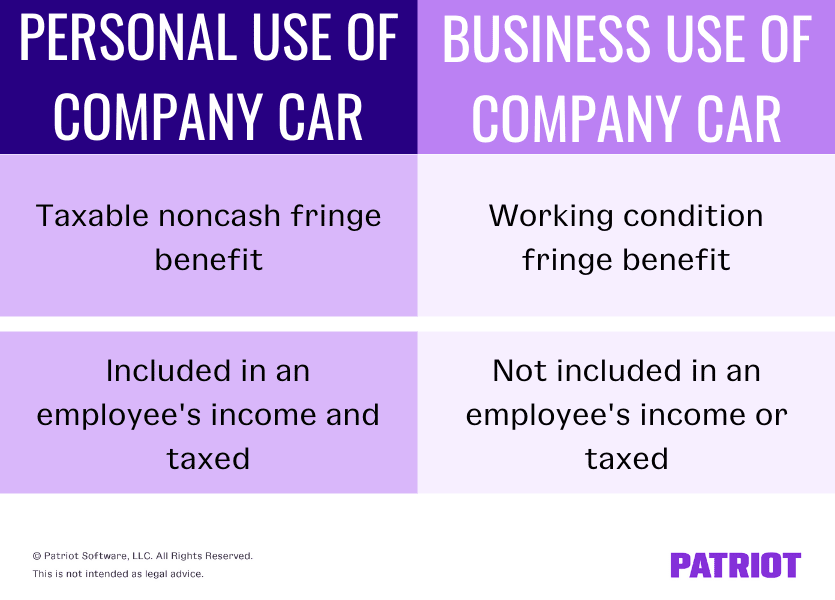

Personal Use Of Company Car Pucc Tax Rules And Reporting

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How Does Leasing A Car Work U S News

Car Lease Tax Changes In Springfield Il Landmark Ford

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Tax Deductions And Business Vehicle Leasing Veturilo

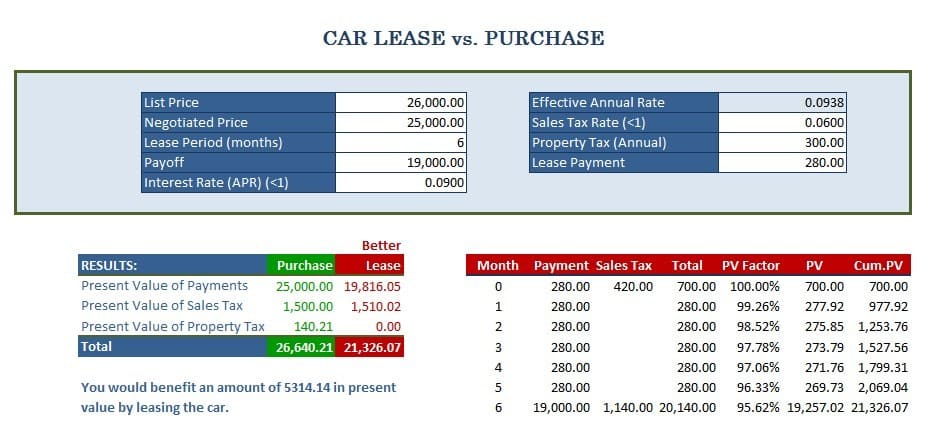

Is It Better To Buy Or Lease A Car Taxact Blog

Pros Cons On Leasing Vehicles David Pope Insurance

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Leasing Vs Buying A Car Which Offers More Tax Savings Turo Tax Tips

Buying Or Leasing A Car For Business What Are The Tax Benefits Slate Accounting Technology

Lease Return Center In North Attleboro Boch Toyota South

New Illinois Sales Tax Law Lowers The Cost Of Leasing A Car Chicago Tribune

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars