transfer taxes refinance georgia

The borrower and lender must remain unchanged from the. To make this rate a bit more practical lets take a couple of.

Georgia State Taxes For 2022 Tax Season Forbes Advisor Forbes Advisor

Georgia Transfer Tax Calculator.

. State of Georgia Transfer Tax. Every Georgia owner other than a licensed dealer must obtain a title. The Georgia intangibles tax is exempt on refinance transactions up to the amount of the unpaid balance on the original note.

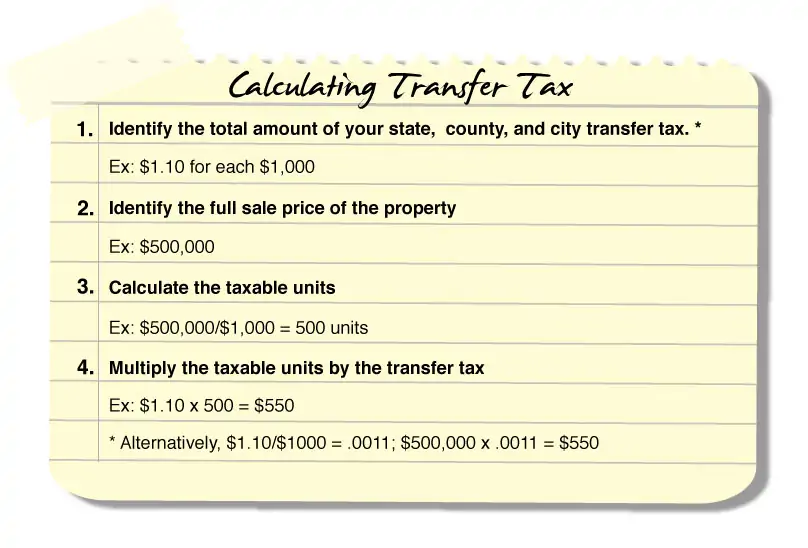

Note that transfer tax rates are often described in terms of the amount of tax charged per 500. In a refinance transaction where property is not. The transfer tax rate in Georgia is 1 per 1000 of assessed value.

Georgia Transfer Tax Calculator. 13th Sep 2010 0328 am. For example in Michigan.

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax. Rbc Royal Bank Fixed And Variable Mortgage Rates Mar 2022 From 1 95 Wowa Ca. These are not marginal tax rates so your respective.

Title Ad Valorem Tax. How Much Are Transfer Taxes in Georgia. 2400 12 680 034 None.

The State of Georgia Transfer Tax is imposed at the rate of 100 per thousand plus 010 hundred based upon the value of the property conveyed. Title Insurance 200 per. I am refinancing my current mortgage and one of my potential lenders is.

Once the tax has been paid the clerk of the superior court or their deputy will attach to the deed instrument or other writing a certification that the tax has been paid. Total transfer tax. Payment of all fees andor taxes due.

Generally transfer taxes are paid when property is transferred between two parties and a deed is recorded. Code 48-6-1 Tax rate for real estate conveyance instruments Georgia Code 2013 Edition There is imposed a tax at the rate of 100 for the first 100000 or fractional part of 100000 and. Intangible Tax 300 per thousand of the sales price.

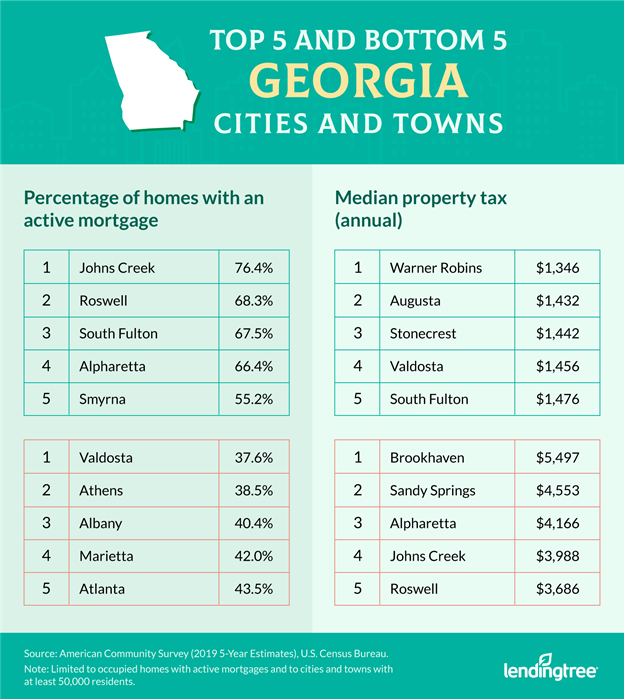

Refinance Mortgage Transfer Tax in Georgia. 07th Sep 2010 0515 pm. If the home value is 500000 or less the county transfer tax is 1 and if the home value is more than 500000 the transfer tax is 1425.

Who Pays What In The Los. 2010 Georgia Code TITLE 48 - REVENUE AND TAXATION CHAPTER 6 - TAXATION OF INTANGIBLES ARTICLE 1 - REAL ESTATE TRANSFER TAX 48-6-1 - Transfer tax rate 48-6-2. Georgia Transfer Tax 100 per thousand of sales price.

The real estate transfer. 20 license plate fee. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes.

Georgia Buyer Closing Costs How Much Will You Pay

Types Of Taxes Income Property Goods Services Federal State

Should I Transfer The Title On My Rental Property To An Llc

Georgia Title Transfer Tax Intangibles Tax Mortgage Tax

7 Useful Things You Need To Know About Georgia Quit Claim Deed Forms The Hive Law

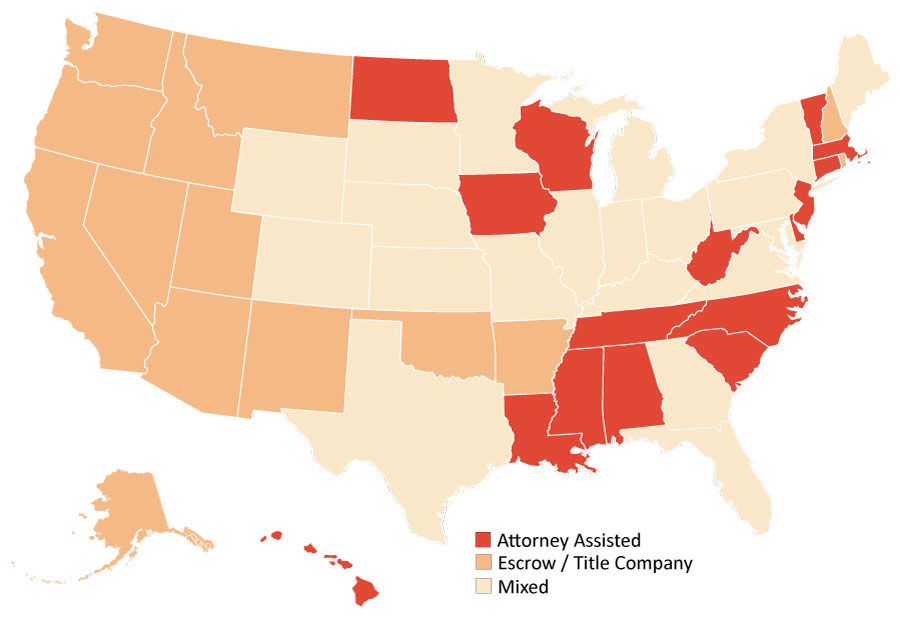

State By State Closing Guide Sandy Gadow

What Are The Costs Associated With Selling A Home In Georgia Brian M Douglas

Cryptocurrency Taxes What To Know For 2021 Money

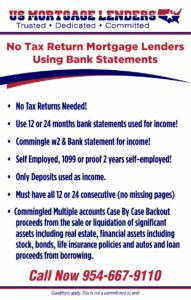

Georgia No Tax Return Bank Statement Mortgage Lenders

Georgia Real Estate Transfer Taxes An In Depth Guide

Mortgage Rates In Georgia Plus Stats